Analyzing real” width=”474″ height=”247″>

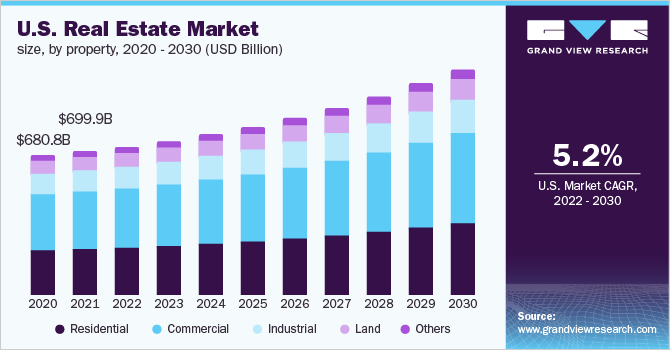

Real estate market data provides valuable insights and information about the current state of the real estate industry. Analyzing this data can help investors, buyers, and sellers make informed decisions, optimize their strategies, and maximize their returns. In this article, we will explore the importance of analyzing real estate market data and the various factors to consider.

The importance of analyzing real estate market data

Analyzing real estate market data is crucial for a variety of reasons:

1. Identifying market trends

Real estate market data allows investors to identify trends and patterns in the market. By analyzing data, one can determine whether the market is experiencing growth, stabilization, or decline. This information is essential to make accurate predictions and adjust investment strategies accordingly.

2. Evaluating property values

Real estate market data provides insights into property values. By analyzing data on recent sales prices, rental rates, and property appraisals, investors can determine whether a property is overvalued or undervalued. This analysis helps in making informed decisions on pricing, buying, or selling properties.

3. Assessing supply and demand

Market data allows investors to assess the supply and demand dynamics in a specific area. By analyzing data on the number of available properties for sale, average time on the market, and the number of new listings, investors can gain insights into the competitiveness of the market. This information helps in setting realistic expectations and developing effective marketing strategies.

4. Mitigating risks

Real estate investments come with inherent risks. Analyzing market data helps investors understand the potential risks within a market, such as oversupply, high vacancy rates, or declining property values. With this information, investors can identify areas of concern and take appropriate measures to minimize risks.

Factors to consider when analyzing real estate market data

When analyzing real estate market data, it is important to consider the following factors:

1. Location

Location is a crucial factor that affects property values and market trends. Analyze data specific to the location of interest, such as neighborhood demographics, proximity to schools, amenities, and transportation. This information helps in evaluating the potential demand and growth prospects of a property.

2. Historical data

Analyzing historical data provides insights into past market trends and helps predict future patterns. Look at data on property prices, rental rates, sales volume, and market activity over several years. By identifying historical trends, investors can make more accurate projections and investment decisions.

3. Economic indicators

Consider economic indicators, such as GDP growth, employment rates, and interest rates when analyzing real estate market data. These indicators influence the demand for properties and affect market conditions. In a growing economy, demand for real estate tends to be higher, driving property prices up. Conversely, a stagnant or declining economy may have a negative impact on property values.

4. Market competition

Understand the level of market competition by analyzing data on the number of active listings, average days on the market, and sales-to-list price ratios. High competition may indicate an oversupplied market, leading to less negotiation power for sellers and more options for buyers. Low competition, on the other hand, may lead to higher property prices and increased demand.

5. Emerging developments

Keep an eye on emerging developments such as infrastructure projects, zoning changes, or new business investments in the area. These developments can significantly impact property values and market dynamics. Analyzing real estate market data in conjunction with these factors helps investors identify upcoming opportunities or potential risks.

Conclusion

Analyzing real estate market data is essential for making informed decisions and maximizing returns in the real estate industry. It allows investors to identify market trends, evaluate property values, assess supply and demand dynamics, and mitigate risks. By considering factors such as location, historical data, economic indicators, market competition, and emerging developments, investors can gain valuable insights into the real estate market and optimize their strategies.