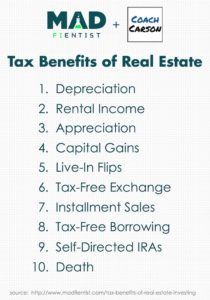

Real estate investing provides a plethora of benefits, one of the most significant of which is the numerous tax advantages it offers to investors. Unlike other investment options, such as stocks or bonds, real estate provides unique tax incentives that can help investors minimize their tax liabilities and maximize their returns. In this article, we will explore some of the key tax benefits of real estate investing.

1. Depreciation Deduction

One of the most significant tax benefits of real estate investing is the ability to take advantage of depreciation deductions. Depreciation is a non-cash expense that allows real estate investors to deduct a portion of the property’s value over its useful life. This deduction can help offset rental income and reduce taxable income, ultimately lowering the investor’s tax liability. Moreover, the depreciation deduction is available even if the property is appreciating in value, making it a valuable tax strategy for real estate investors.

2. Mortgage Interest Deduction

Another significant tax benefit of real estate investing is the ability to deduct mortgage interest payments. If you finance the purchase of an investment property with a mortgage, the interest on that mortgage is tax-deductible. This deduction can significantly reduce your taxable income and result in substantial tax savings. However, it’s important to note that this deduction is only applicable to investment properties and not to primary residences.

3. Capital Gains Tax

Real estate investment provides favorable treatment when it comes to capital gains tax. If you sell a property that you have held for more than a year, any profit you make from the sale is considered a long-term capital gain. Long-term capital gains are generally subject to a lower tax rate than ordinary income. This preferential tax treatment encourages long-term real estate investment, as investors can benefit from lower taxes on their investment returns.

4. 1031 Exchange

The 1031 exchange, also known as a like-kind exchange, is a provision in the tax code that allows real estate investors to defer capital gains taxes when they sell a property and reinvest the proceeds into another property of similar value. By using a 1031 exchange, investors can effectively “exchange” properties while deferring tax payments. This allows investors to continue growing their real estate portfolio without incurring immediate tax liabilities.

5. Passive Loss Deduction

Investors who actively participate in real estate activities can deduct up to $25,000 in losses against their ordinary income. This deduction is available to individuals with adjusted gross incomes below $100,000 and phases out gradually as income exceeds this threshold. This provision allows real estate investors to offset income from other sources with losses incurred from their real estate investments, resulting in reduced taxable income.

6. Tax-Free Cash Flow

Real estate investments offer the potential for tax-free cash flow. Cash flow refers to the income generated by an investment property through rental payments. The income derived from rental properties can often be offset by deductible expenses such as mortgage interest, property taxes, maintenance costs, and depreciation. As a result, the net cash flow from real estate investments can be tax-free or significantly minimized, providing investors with a reliable income stream without incurring high tax liabilities.

Conclusion

Real estate investing presents numerous tax benefits that can help investors reduce their tax liabilities and increase their overall returns. From depreciation deductions to the 1031 exchange provision, these tax advantages make real estate a highly attractive investment option. However, it’s crucial for investors to consult with a tax professional or financial advisor to fully understand and optimize these tax benefits within the confines of the tax law.